Smaller Banks, Bigger Unions

Smaller Banks, Bigger Unions

But if this is such a good idea for UK banks (and UK energy companies for that matter), then why doesn't Ed Miliband and the Labour Party propose the same policy prescription for the trade unions where there are only 3 big trade unions operating in the public sector - GMB, Unison and Unite?

So, if anything, the case for greater diversity and competition is even more pressing - especially as the behaviour of trade unions is not subject to any kind of independent oversight or regulation.

Monday, 11 November 2013

Smaller Banks, Bigger Unions (11 November 2013)

Here's another post from the blog site archive which, to my mind, is as relevant today as it was when I wrote the first piece - back in 2009.

I find it hilarious that the Labour Party gets all worked up about monopolies in certain parts of society, yet turns a blind eye to the lack of choice - or proper independent regulation - when it comes to the activities of the 'big three' unions which completely dominate our public services.

News reports during the week suggested that the boss of Britain's third largest union - Paul Kenny of the GMB - is preparing to stand down early from his post.

Has this anything to do with the likely merger between GMB and Unison?

I don't know, I have to admit.

But if and when a new union comes about - GUMBO or whatever it's called will have around 1.9 million members - even more than the current pack leader, Unite, with 1.5 million members.

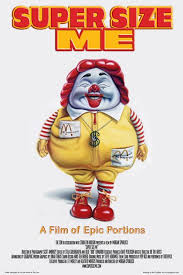

I would say it's time that people stopped and ask themselves whether this trend towards supersized unions is in the interests of ordinary union members.

Because in any other walk of life it wouldn't be allowed - without putting a series of checks and balances into the system.

Supersize Me (21 January 2012)

Britain's union bosses (the Bubs) are always banging on about the need for healthy competition on the high street - and the benefits of cutting the big banks down to size.

But the unions are allowed to play by very different rules themselves - seems like they just keep on getting bigger and bigger - and growing in size.

The latest union merger on the cards is one between Unite and PCS (the civil service union) - both of whom are on a collision course with the government over public sector pensions.

A new union would have a combined membership of 1.8 million members - in effect a new super union would be created - which would dwarf second placed Unison with only 1.3 million members.

But of course Unison and GMB have already been in merger talks for some time - and if they agree to tie the knot - then only two unions would represent 3.6 million people - the bulk of the UK's union membership.

At a time when big monopoly suppliers of services - generally speaking - have acquired a pretty bad name for being able to dictate terms to their customers - because of the lack of choice and inability to take their business elsewhere.

The creation of these ever-bigger 'super-size' unions also has big implications for the Labour party.

Because as everyone knows the trade unions effectively decided the outcome of the recent Labour leadership elections - both Ed Miliband and Johann Lamont owe their positions to union votes - from GMB, Unison and Unite.

So in future only two Bubs may have this level of influence and if the trend continues, who knows - maybe there will be just one.

Now there are some arguments to be made for 'big is best' - including the usual ones about economies of scale and so forth.

But the problem with the trade union sector is that it is almost entirely unregulated - ordinary union members have nowhere to go if they have a complaint - in terms of an independent outside body at least.

If these mergers were taking place in the private sector - they would be referred to the Monopolies and Mergers Commission - which happened recently when News International trying to buy Sky TV.

In addition other parts of society - both public and private - what goes on is regulated by a whole host of public watchdogs - and while you can argue about their effectiveness in some cases - at least they exist.

Here's what I had to say on the subject back in November 2009.

Smaller Banks, Bigger Unions (November 6th 2009)

Much has been said - and written - this week about cutting the big high street banks down to size.

Apparently everyone now believes that smaller banks are good for us. Because smaller banks means more banks - that have to compete with one another - and the resulting competition is good for customers.

The big guy always finds it much harder to beat up on the little guy - if the little guy can just take his or her business elsewhere.

So far, so good - sounds reasonable enough.

But isn't it interesting that while the big banks are being forced to become smaller - to get closer to their customers - that trade unions in the UK are becoming ever larger and more remote from their members.

The latest move towards another super union - see post dated 16 September 2009 - is the planned merger between GMB and Unison - which would create a union of around 2 million members.

But Unison itself is the product of an arranged marriage of what used to be three separate unions - COSHE, NALGO and NUPE - which tied the knot to become Unison in 1993.

And this latest giant union is all about keeping up with the Joneses, in the shape of Unite - currently the largest union in the land with 1.5 million members - and itself the product of a previous merger between Amicus and the old transport union, TGWU.

The fact is that these new super unions are run just like giant businesses - except that they are not as well regulated as businesses - arguably they are subject to less scrutiny than your average corner shop.

In terms of service standards - ordinary union members do not have an independent body to turn to for support, if they have a problem or complaint - there is no equivalent of the Financial Services Ombudsman, for example.

In future, union members will get even less choice from these mega unions - which all give huge sums of money to the Labour Party - despite the fact that the great majority of union members support other parties - or no party at all.

The present government has no interest in making the union more accountable to their members - because the Labour Party is so heavily dependent on the trade unions for financial support.

But it will be interesting to see what happens after the next general election - maybe the unions will be forced to move with the times. A healthy dose of external and independent scrutiny - would certainly help the unions become more accountable to their members.

Has this anything to do with the likely merger between GMB and Unison?

I don't know, I have to admit.

But if and when a new union comes about - GUMBO or whatever it's called will have around 1.9 million members - even more than the current pack leader, Unite, with 1.5 million members.

I would say it's time that people stopped and ask themselves whether this trend towards supersized unions is in the interests of ordinary union members.

Because in any other walk of life it wouldn't be allowed - without putting a series of checks and balances into the system.

Supersize Me (21 January 2012)

Britain's union bosses (the Bubs) are always banging on about the need for healthy competition on the high street - and the benefits of cutting the big banks down to size.

But the unions are allowed to play by very different rules themselves - seems like they just keep on getting bigger and bigger - and growing in size.

The latest union merger on the cards is one between Unite and PCS (the civil service union) - both of whom are on a collision course with the government over public sector pensions.

A new union would have a combined membership of 1.8 million members - in effect a new super union would be created - which would dwarf second placed Unison with only 1.3 million members.

But of course Unison and GMB have already been in merger talks for some time - and if they agree to tie the knot - then only two unions would represent 3.6 million people - the bulk of the UK's union membership.

At a time when big monopoly suppliers of services - generally speaking - have acquired a pretty bad name for being able to dictate terms to their customers - because of the lack of choice and inability to take their business elsewhere.

The creation of these ever-bigger 'super-size' unions also has big implications for the Labour party.

Because as everyone knows the trade unions effectively decided the outcome of the recent Labour leadership elections - both Ed Miliband and Johann Lamont owe their positions to union votes - from GMB, Unison and Unite.

So in future only two Bubs may have this level of influence and if the trend continues, who knows - maybe there will be just one.

Now there are some arguments to be made for 'big is best' - including the usual ones about economies of scale and so forth.

But the problem with the trade union sector is that it is almost entirely unregulated - ordinary union members have nowhere to go if they have a complaint - in terms of an independent outside body at least.

If these mergers were taking place in the private sector - they would be referred to the Monopolies and Mergers Commission - which happened recently when News International trying to buy Sky TV.

In addition other parts of society - both public and private - what goes on is regulated by a whole host of public watchdogs - and while you can argue about their effectiveness in some cases - at least they exist.

Here's what I had to say on the subject back in November 2009.

Smaller Banks, Bigger Unions (November 6th 2009)

Much has been said - and written - this week about cutting the big high street banks down to size.

Apparently everyone now believes that smaller banks are good for us. Because smaller banks means more banks - that have to compete with one another - and the resulting competition is good for customers.

The big guy always finds it much harder to beat up on the little guy - if the little guy can just take his or her business elsewhere.

So far, so good - sounds reasonable enough.

But isn't it interesting that while the big banks are being forced to become smaller - to get closer to their customers - that trade unions in the UK are becoming ever larger and more remote from their members.

The latest move towards another super union - see post dated 16 September 2009 - is the planned merger between GMB and Unison - which would create a union of around 2 million members.

But Unison itself is the product of an arranged marriage of what used to be three separate unions - COSHE, NALGO and NUPE - which tied the knot to become Unison in 1993.

And this latest giant union is all about keeping up with the Joneses, in the shape of Unite - currently the largest union in the land with 1.5 million members - and itself the product of a previous merger between Amicus and the old transport union, TGWU.

The fact is that these new super unions are run just like giant businesses - except that they are not as well regulated as businesses - arguably they are subject to less scrutiny than your average corner shop.

In terms of service standards - ordinary union members do not have an independent body to turn to for support, if they have a problem or complaint - there is no equivalent of the Financial Services Ombudsman, for example.

In future, union members will get even less choice from these mega unions - which all give huge sums of money to the Labour Party - despite the fact that the great majority of union members support other parties - or no party at all.

The present government has no interest in making the union more accountable to their members - because the Labour Party is so heavily dependent on the trade unions for financial support.

But it will be interesting to see what happens after the next general election - maybe the unions will be forced to move with the times. A healthy dose of external and independent scrutiny - would certainly help the unions become more accountable to their members.